In the current landscape of the DC Metro Real Estate Market, amidst its dynamic changes, we recognize that global events, particularly the conflict between Palestine and Israel, are profoundly affecting numerous families within our community. As these situations evolve, our commitment remains steadfast in understanding and enhancing how we can best serve and support our neighbors during these challenging times. Given that our work in real estate is intricately connected to the well-being of our clients and community, we aim to frame this month’s market update within this broader context.

Shifting our focus to the market scenario:

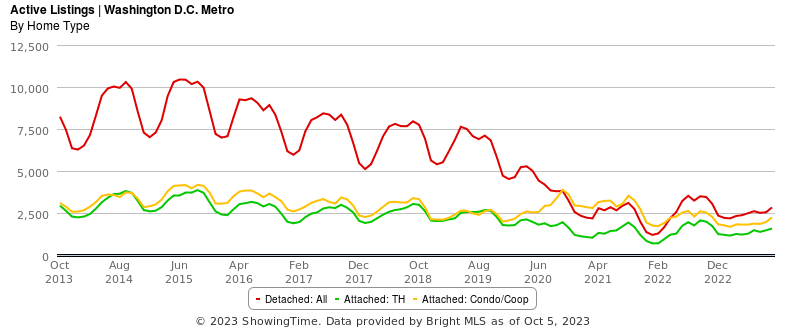

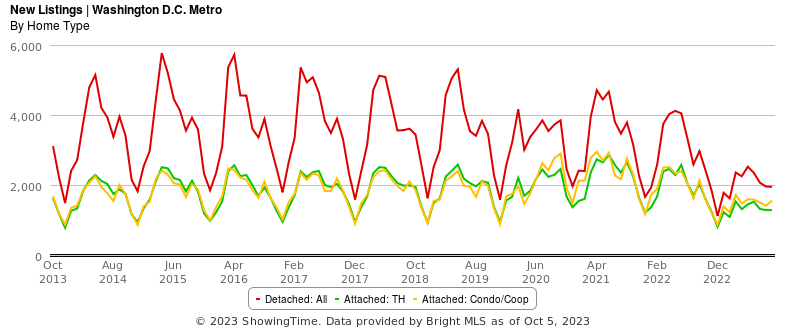

The DC area is witnessing a persistently low number of homes for sale across all types compared to previous years. Although there was a slight increase in listings in September, aligning with typical seasonality, we anticipate listings to continue rising in October, followed by a decrease through November to February, with a subsequent rise in the Spring market.

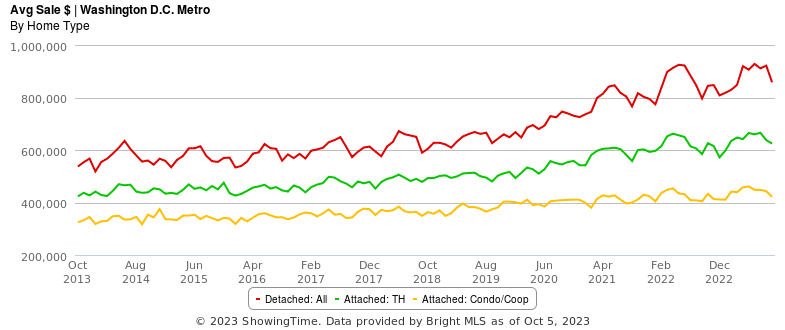

The average sales price experienced a decline last month, consistent with the seasonal slowdown of fall and winter. Despite a cooling down from the historically high prices of summer, home prices remain approximately 6% higher than this time last year across all home types.

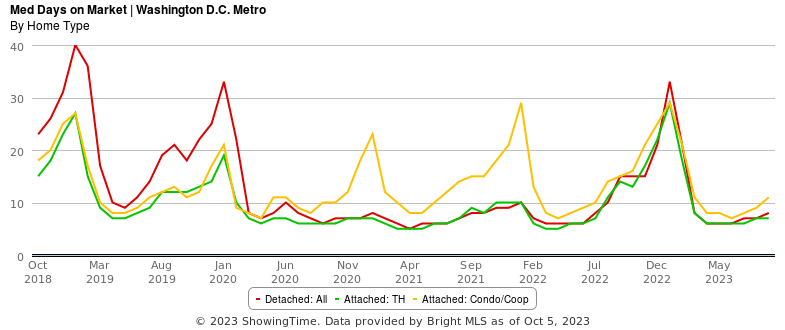

While the need for more listings persists, the number of new listings in September has remained relatively steady, contributing to tight inventory. Although active listings have shown a slight increase, signaling a potential cooling market, the overall market remains favorable for sellers, with detached homes spending an average of 8 days on the market.

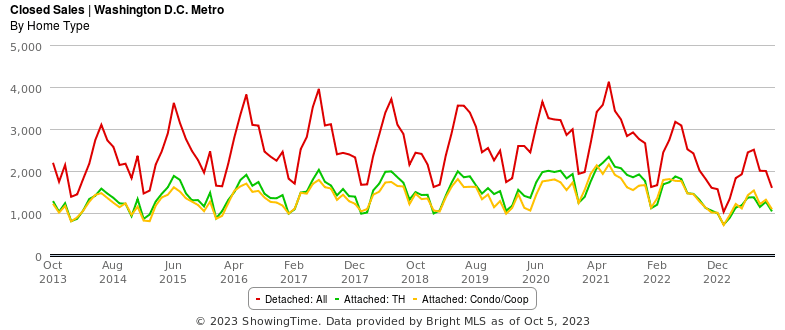

Predictably, there was a decrease in the number of closed sales in September due to low inventory, leading many buyers to postpone their decisions. Across all home types, closed sales are down by 19% compared to the same period last year.

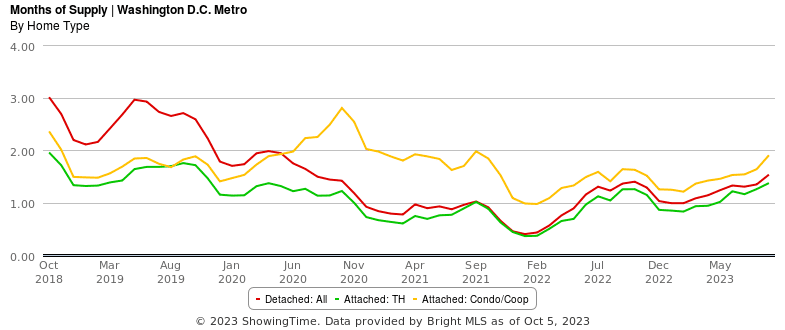

As the number of active listings increases and new listings stay consistent, inventory in the housing market is gradually rising, particularly in the condo market. Currently, there is approximately 1.5 months of supply for single-family homes and townhomes, while condos have close to a 2-month supply, maintaining a sellers market for now.

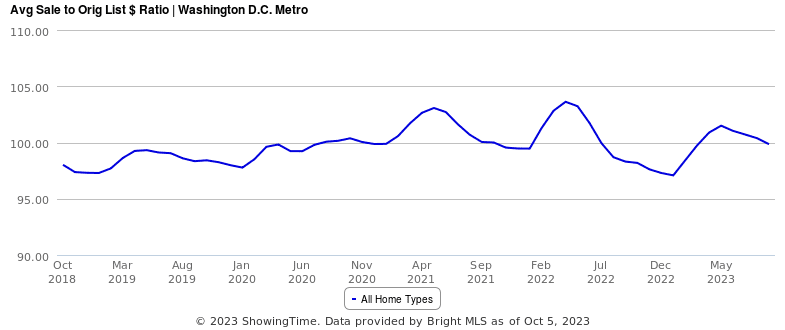

For the first time since March, the average sales price to the original list price ratio dropped below 100%, indicating that homes are, on average, selling at or slightly below the listing price.

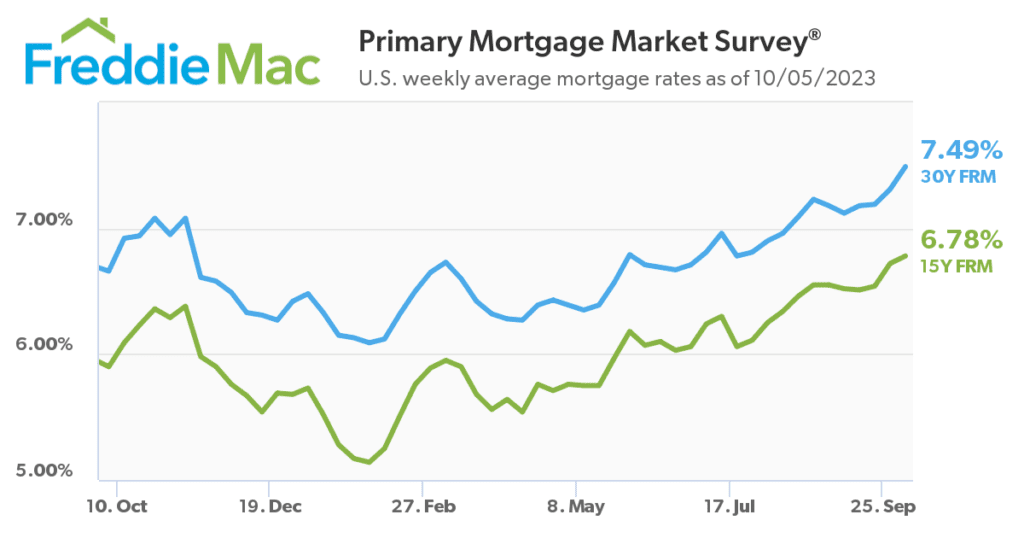

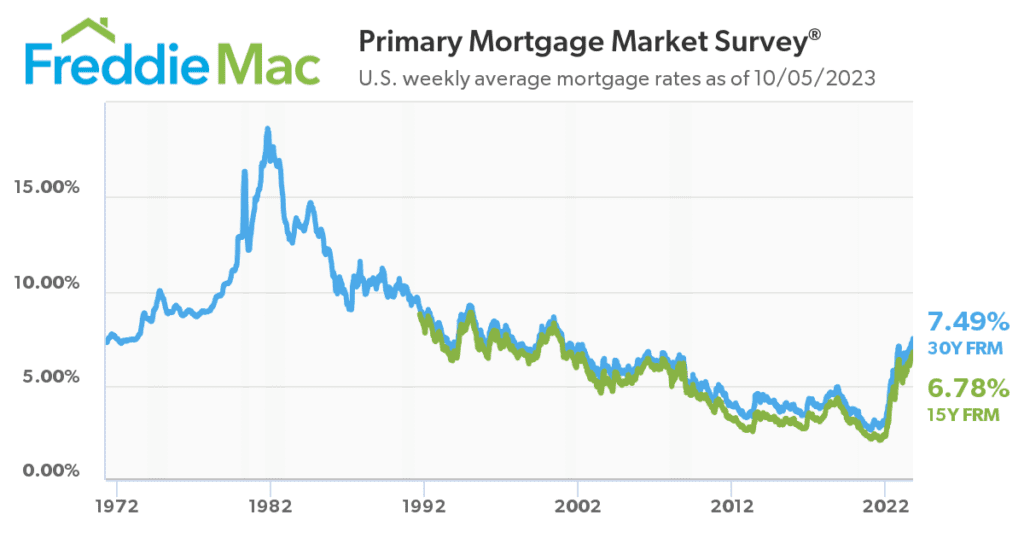

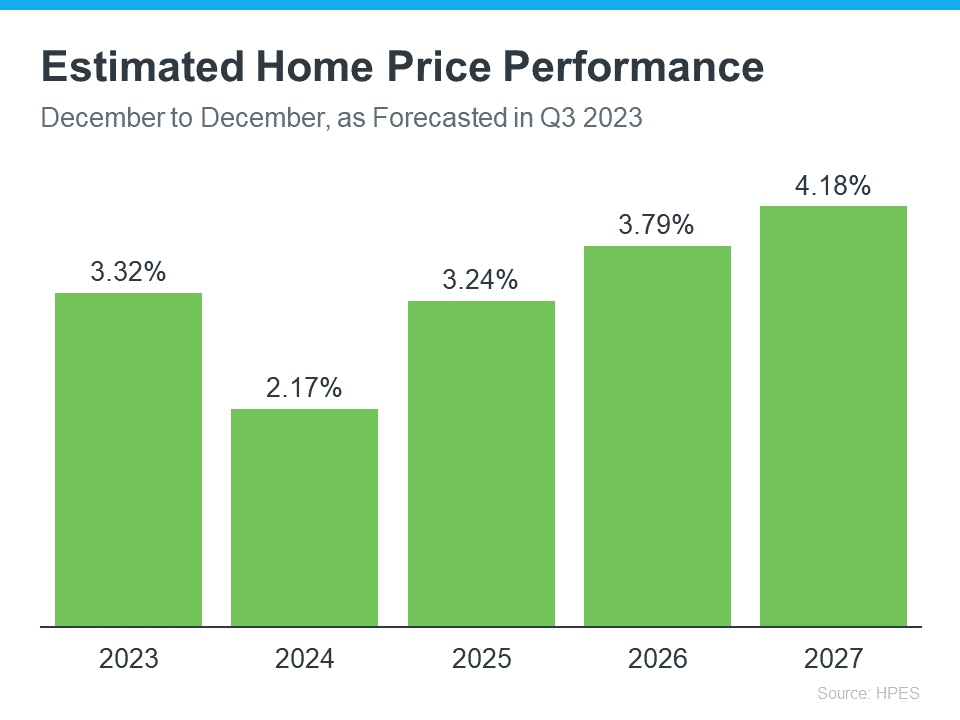

Mortgage rates have continued to rise, reaching around 7.5%, although some programs are offering rates in the 6’s. While the past year might seem challenging, a broader perspective on mortgage rates over time suggests a different narrative. According to a home price expectations survey conducted by 100 top economists, home prices are expected to rise between 2-4% each of the next 5 years.

In conclusion, our thoughts for buyers, sellers, and investors are as follows:

For Buyers:

Seasonal factors and increased inventory are influencing home prices downward.

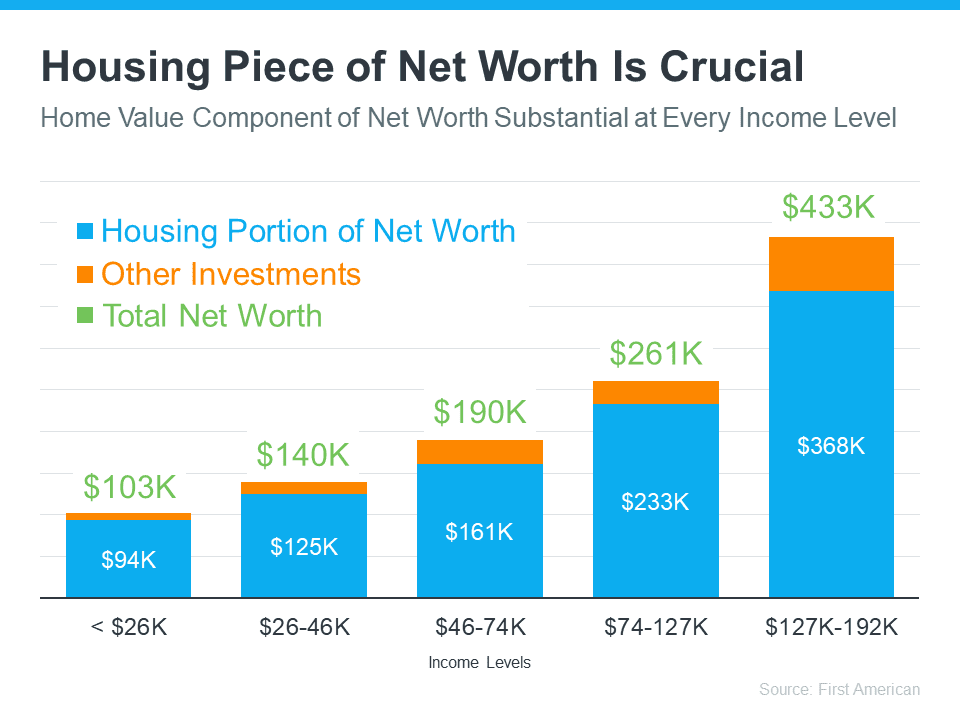

Despite high interest rates, historical context indicates that buying a home remains a solid option for building equity and growing net worth.

The average sales price to the original list price dropping below 100% suggests a potential cooling off, making it an opportune time for buyers.

For Sellers:

While inventory is increasing, it remains historically low compared to past years, coupled with sustained high demand.

This presents a favorable moment for sellers to evaluate their home equity and consider moving to a space better suited to their needs.

For Investors:

Cash holds significant value, and the demand in the market is high.

If a good value is found, it’s an opportune time to buy and engage in real estate activities like renting or fixing and flipping.

In the midst of international conflicts and ongoing market dynamics, we acknowledge that life continues for you and your family. As trusted advisors, we are here to support you in this crucial decision of owning real estate. Now more than ever, please let us know how we can assist you. We value and appreciate your trust, and we are committed to serving you and the people you care about.