This spring has been far from typical for the Washington, D.C. housing market. While spring is traditionally the busiest season for real estate, this year’s activity has been noticeably muted. According to Erica Plemmons, a housing market researcher at Bright MLS, the best way to describe the current market is with two key words: “subdued” and “uncertain.”

“We are seeing activity that maybe is not as blooming as we typically see in the spring housing market,” Plemmons explained. “And the other word that comes to mind is ‘uncertain,’ especially when buyers are questioning whether now is the right time to make a purchase or if they should wait.”

This hesitation is rooted in a complex mix of economic factors that are putting pressure on both buyers and sellers. Falling consumer confidence, concerns about a slowing economy, personal financial strain, and local impacts from federal job and spending cuts are all adding to the uncertainty. These headwinds are further exacerbated by persistently high borrowing costs and record-setting home prices in the region.

“For individuals in a position to buy or sell, this is a major financial decision,” Plemmons said. “If people feel unsure about their income stability in the near future, they’re much less likely to move forward with such a significant commitment.”

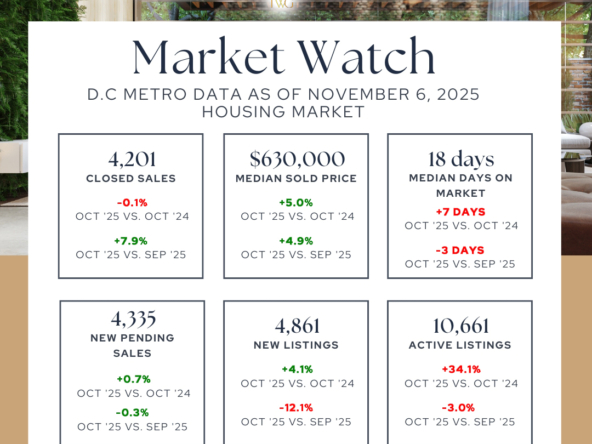

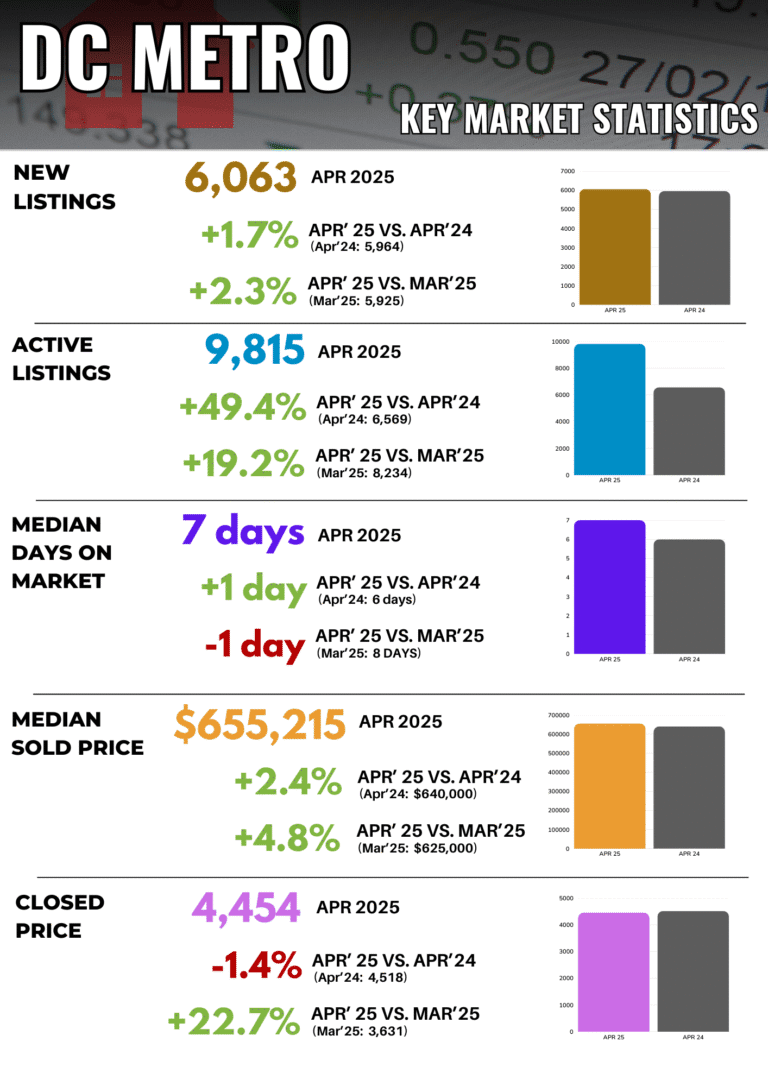

The impact of this cautious sentiment is already visible in the numbers. In April, pending home sales across the D.C. region declined by 2.5% compared to the same time last year. Showings by real estate agents were down by 8.1%, reflecting decreased buyer interest and activity. Meanwhile, the number of homes on the market increased by 29.2% compared to April 2023, indicating growing inventory due to slower turnover.

However, the market is not uniform across all property types. Detached single-family homes remain in high demand, even though they are typically the most expensive and hardest to find. Inventory for this category remains below pre-pandemic levels. “Compared to April of 2019, we still have a deficit in available detached single-family homes,” Plemmons noted. “Conversely, attached homes and condos are more plentiful than they were in 2019.”

Interestingly, despite the slowdown in transactions and the broader economic concerns, home prices continue to rise—particularly for single-family homes. In April, the median sold price in the D.C. metro area reached a new record high. Although the pace of price growth has decelerated, rising just 3.7% year-over-year, this is still notable considering the overall drop in buyer activity. In fact, this marks the slowest rate of price appreciation since June 2023, suggesting that while prices are still climbing, the market may be beginning to stabilize.

Overall, the D.C. housing market is navigating a complicated spring season. High costs, economic uncertainty, and evolving buyer behavior are reshaping traditional patterns. For both buyers and sellers, the current environment demands careful consideration, patience, and a well-informed strategy.