I've had the incredible privilege of being featured in Maryland Realtor Magazine Vol LVII Jun/Jul 2023 where we talked about Diversity, Equity & Inclusion (DEI) and also lead the MARYLAND committee as the Chair for our esteemed CCIM MID-ATLANTIC chapter. If you're immersed in the commercial business realm, brace yourself for a wave of excitement as we have an array of captivating commercial education...

Real Estate News

Here are the highlights for the week ending June 4, 2023: Dip in new contracts. As expected, there was a decline in new contract activity in the Mid-Atlantic for the week ending June 4, 2023. After the lower showing traffic last week, fewer offers and acceptances followed. In good news, that means a rebound is anticipated next week. But contracts continue to lag their 2022 peers as interest rates now...

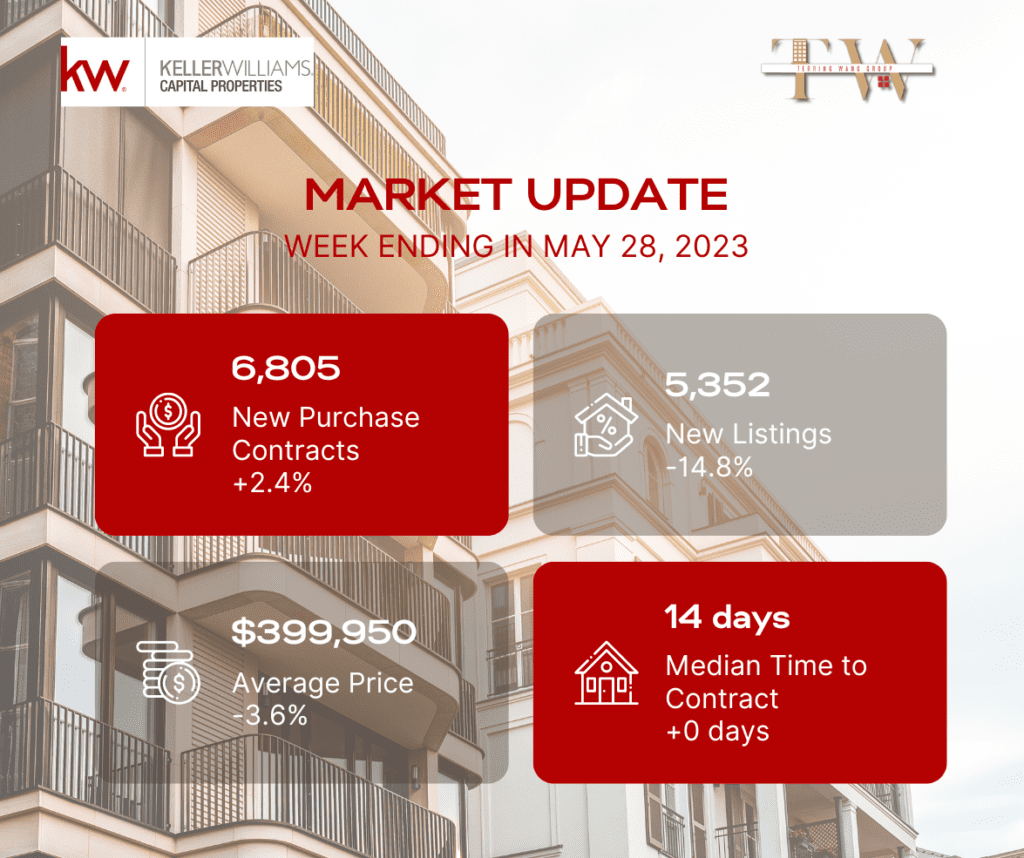

The week ending May 28, 2023, saw a drop in new listings and showing traffic due to the Memorial Day weekend. The Mid-Atlantic region experienced a decline of 14.8% in new listings compared to the previous week and a 26.0% decrease compared to the same week in 2022. This year's new listings have consistently lagged behind 2022, leading to low inventory levels. Buyer showing traffic also...

Montgomery County is experiencing a significant housing shortage, affecting everyone from teachers and immigrants to young families and seniors. As the county grapples with addressing this issue, there are three major factors that could play a significant role in shaping the future of housing: Thrive 2050, the Purple Line, and rent stabilization legislation. In this comprehensive article, we will discuss...

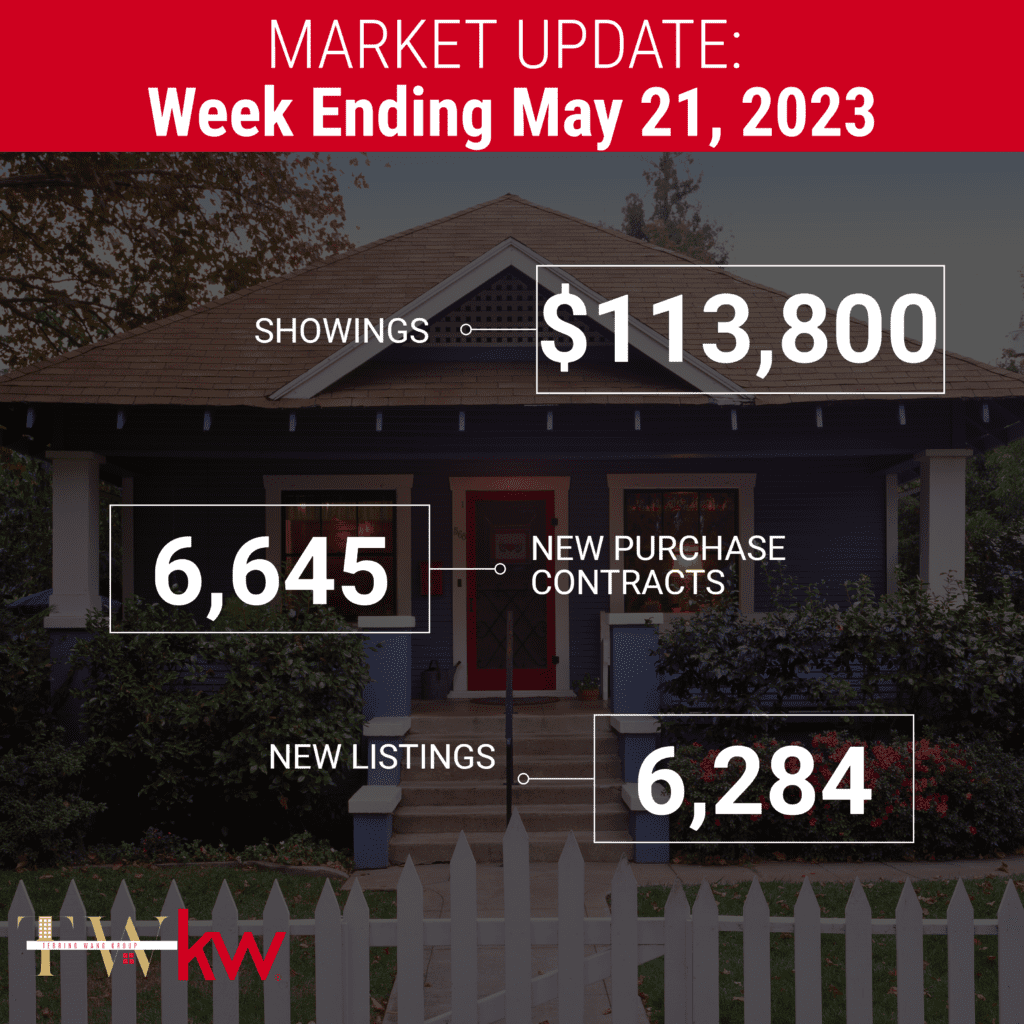

Highlights for the week ending May 21, 2023 The number of new listings in the Bright MLS footprint has been gradually increasing, although at a slower pace. Compared to previous years, there is a noticeable decrease in the number of new listings. For the week ending May 21, 2023, new listings are 24.0% lower than the same period last year. Despite the absence of the usual spring surge in listings, there...

Let us turn your dream home into a reality. With our expert partners, we offer stress-free solutions for buying, building, or renovating your...

The Weekly Market Report provides an up-to-date listing and showing information to help you track market activity in real-time. These reports are posted to this page as they are released. Here are the highlights for the week ending May 14, 2023: Slow, persistent growth in contracts. New purchase contracts across the Bright MLS footprint rose 1.2% from last week. While bumpy from week to week, there...

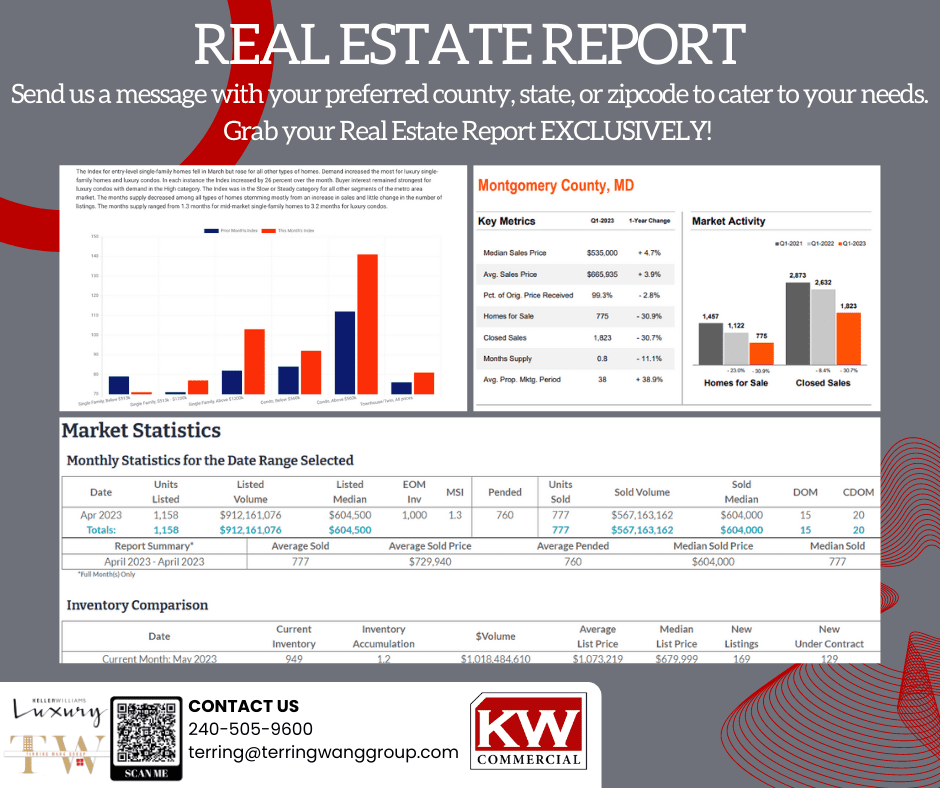

Unlock the Latest Real Estate Market Insights! 🏡💼📊 As your trusted real estate advisors, we have exclusive access to the latest market reports. Simply contact us and provide the county, state, or zipcode of the area you're interested in, and we'll provide you with the most up-to-date data and trends. Don't miss out on this valuable information – reach out to us...

A new home may be within reach. Get a grant of up to $7,500 toward the purchase of a primary residence with a mortgage loan. Qualified buyers may be able to purchase a new home in targeted markets, with help from our Grant Program. Requirements: • Buyers must purchase a one-unit primary residence within a county on the Grant Targeted Markets list (see back page). • The grant may be awarded for...

After a few years of flying high, home prices are finally coming back down to earth with a thud. In fact, the prospect of an outright price drop is looming on the horizon, according to a new Realtor.com report. In March, real estate listing prices came in nationwide at a median of $424,000, down from June’s all-time record high of $449,000. And while this March’s prices are 6.3% higher than in...