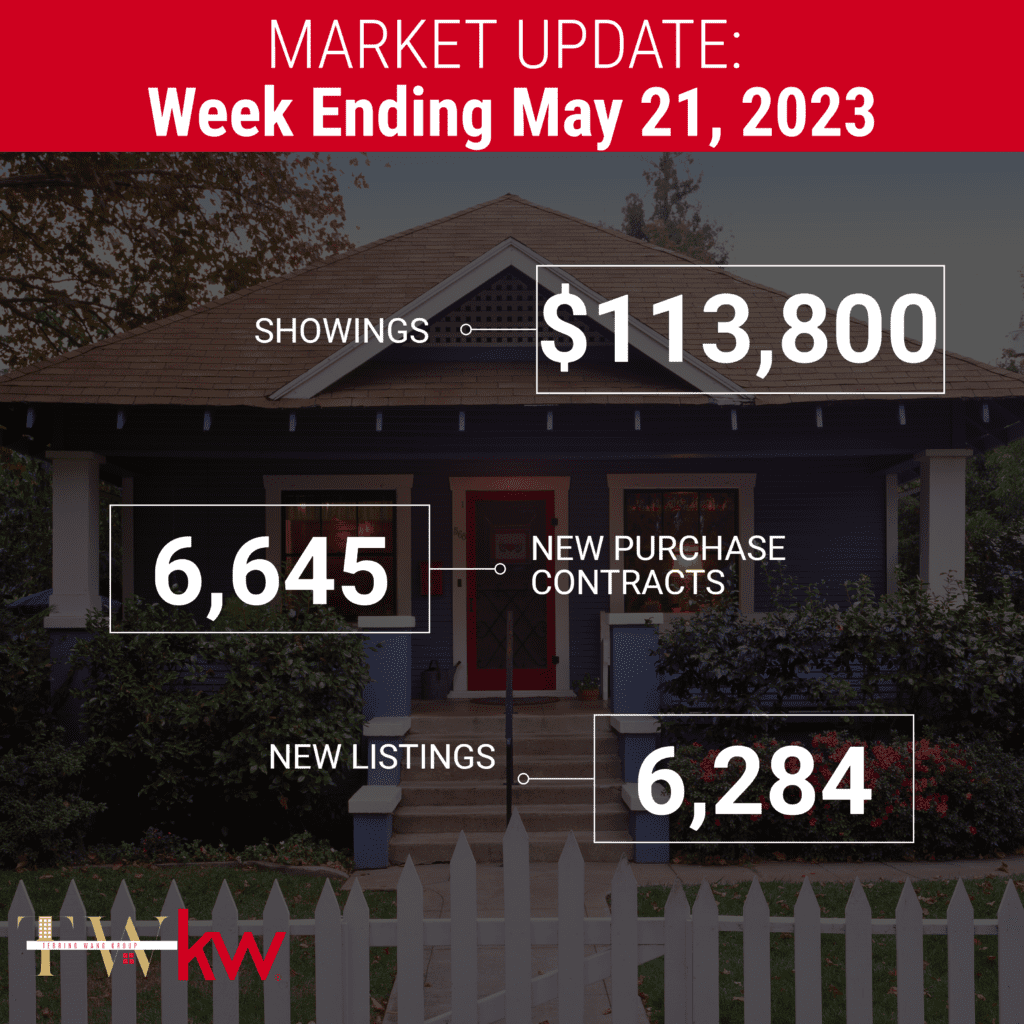

Highlights for the week ending May 21, 2023 The number of new listings in the Bright MLS footprint has been gradually increasing, although at a slower pace. Compared to previous years, there is a noticeable decrease in the number of new listings. For the week ending May 21, 2023, new listings are 24.0% lower than the same period last year. Despite the absence of the usual spring surge in listings, there...

home buyers

After a few years of flying high, home prices are finally coming back down to earth with a thud. In fact, the prospect of an outright price drop is looming on the horizon, according to a new Realtor.com report. In March, real estate listing prices came in nationwide at a median of $424,000, down from June’s all-time record high of $449,000. And while this March’s prices are 6.3% higher than in...

The takeover by banking regulators this month of Silicon Valley Bank and Signature Bank has conjured up the ghost of the Great Recession.Of the 523 bank failures since 2008, Federal Deposit Insurance Corp. figures show, only one was larger than either Silicon Valley Bank or Signature Bank. That would be Washington Mutual Bank, which had $307 billion in assets, while Silicon Valley Bank had $209 billion and...

For many home shoppers, buying a house right now can seem like a very pricey pipe dream. Mortgage interest rates still hover at an uncomfortably high mid-6% range for 30-year fixed-rate loans. And the Realtor.com® economists expect home prices will rise 5.4% year over year in 2023. Those factors mean buying a home right now is an expensive endeavor. But this doesn’t mean your goal of...

Buyers got on a roller coaster in January 2022 and stayed strapped in for the real estate market loops throughout the year. Mortgage rates were low, then soared to a 20-year high of 7.08% before dipping again. Median national list prices rose to a historic $450,000, and then they, too, began to fall. Homes in July were snatched up in 34 days—and come November, they lingered on the market for 56...